Hello Stern IR Clients,

We want to start this morning by congratulating several Stern IR clients on major accomplishments, all from this week alone!

- Atea priced its initial public offering, raising approximately $300M. Go AVIR! (here).

- Kala Pharmaceuticals announced FDA approval of EYSUVIS for the short-term treatment of the signs and symptoms of dry eye disease (here).

- Scholar Rock announced positive proof-of-concept data from its TOPAZ Phase 2 trial interim analysis of SRK-015 in patients with Type 2 and Type 3 SMA (here), and subsequently raised $200M in a follow-on offering (here).

- Scorpion Therapeutics launched with a $108M Series A to advance Precision Oncology 2.0 (here).

- Syros Pharmaceuticals announced initial data from its Phase 1 clinical trial of SY-5609, demonstrating proof-of-mechanism at tolerable doses (here).

13F Update: A Win for Transparency!

We’ve written several times about the SEC’s proposal to change 13F filing rules so that only fund managers with over $3.5B in equities would have to publicly report their holdings, rumored to be prompted by hedge funds who wished to avoid position disclosures. As we all know, this proposal was not particularly popular. In fact, the SEC received 2,238 letters opposing their changes to the 13F requirements, and only 24 in favor! Earlier this week, Bloomberg reported that the SEC is likely shelving its controversial plan.

While the SEC hasn’t made any public comments yet, it sounds like insiders at the agency were surprised by the level of public opposition to their proposal. And, while they continue to believe that the $100M trigger is outdated, they recognize that 13F filings are being used in ways they had not anticipated when the form was adopted (i.e., to track potential activists and help fend off their campaigns) and are now focused on examining these issues before moving forward with a new proposal. Stay tuned!

Even More SPACs

The SPAC party continues! Last week, two notable new SPACs were announced: Bain executives Adam Koppel and Jeffrey Schwartz raised $125M for their SPAC, BCLS Acquisition Corp. (which in addition to its well-known sponsors has a pretty impressive board, including Barry Greene, Allene Diaz and Vikas Sinha), and Stelios Papadopoulos, the chairman of Biogen, raised $100M for a SPAC, Eucrates Biomedical Acquisition, which was formed by Vedanta Management at the end of 2019.

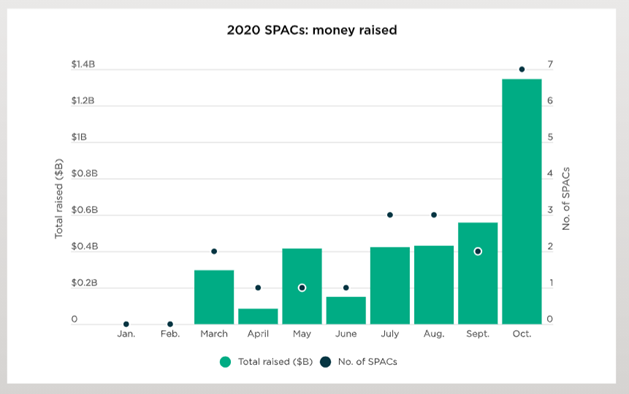

To learn more about SPACs, take a look at last week’s BioCentury, which featured a prominent SPAC review article. This chart, which shows the total amount of money raised by SPACs this year, pretty much says it all!:

Market Update:

The markets were down this week, with the NASDAQ, DJI, and S&P 500 falling 3%, 6% and 4% respectively. The VIX gained a hefty 30% this week, sitting at 36.55 as of market close on 10/29. The biotech indices performed similarly, with the NBI, BTK, and XBI closing down 2%, 2% and 2% respectively.

That said, the financing markets remain friendly to biotech companies and investors alike. This week, TVM Capital Life Science, a German-Canadian VC fund and high profile Eli Lilly Partner, raised $478M for their new fund, which plans to invest in about 16-18 companies with a single-asset who are at or nearing the IND-enabling phase, as well as 10-12 late-stage companies.

Additionally, last week RA Capital closed its latest round, raising $461M in its Nexus II fund, which will invest in private companies across the biotech industry. Note that this comes just over 15 months after launching its first venture fund, which raised $300M and has churned through roughly 80% of its capital already, investing in 59 companies across 18 distinct areas, 15 of which have already gone public or been acquired.

MD Anderson launched its Cancer Focus Fund, with $50M of initial capital to advance investigational cancer therapies from late preclinical development through Phase 1 and Phase 1b/2 trials.

Additionally, several financing deals priced:

- Four IPOs: Stern IR Client Atea ($300M), Biodesix ($72M), Galecto ($85M) and SQZ ($71M).

- Six follow-ons: In addition to Stern IR Client Scholar Rock ($200M) — Allakos ($250M), Forte ($40M), Mirati ($800M), Turning Point ($400M), Ultragenyx ($396M).

On the private side, Stern IR Client Scorpion launched on Monday with a $108M Series A. Other private rounds from this week include LianBio (Undisclosed, $310M), Longboard Pharmaceuticals (Series A, $56M), Primmune (Series A, $27.4M), Q32 Bio (Series B, $60M), Senda Biosciences (Series A, $88M).

Very best,

The team at Stern IR