From large institutional investors to smaller quantitative investors, proxy voting guidelines increasingly reference ESG issues such as board diversity and climate change, requiring companies to meet a minimum ESG performance threshold for investors to vote in accord with management. Companies failing to meet investors’ ESG requirements risk losing key votes and are prone to investor activism.

By launching ESG efforts in 2023, companies not only position themselves for positive voting outcomes, but also build positive relationships with the set of long-term, engaged investors that will strengthen their investment base for years to come. Given the strength of investors’ commitments to ESG and the extent to which ESG influences proxy voting behavior, healthcare companies are well-advised to launch ESG programs and proactively seek to satisfy investors’ requirements on board diversity, human capital and DEI. By tackling climate risk and GHG emissions, companies also satisfy investors’ expectations around board and director accountability for ESG and climate change. ESG is an ongoing process accessible and relevant to companies throughout the year and at every stage of development.

As this year’s proxy landscape began to take shape, Forbes noted a marked increase in ESG activity, announcing the proxy ballot had finally taken “center stage” for ESG[1]. The Wall Street Journal urged companies to brace themselves for an “onslaught of new activists” in 2023 following the SEC’s universal proxy card amendment.[2] While most health care companies felt little or no impact from ESG during proxy season in 2022, there is reason to believe this year’s outcome could look substantially different.

On the bright side, plenty of evidence exists to help us understand not only how voting season might unfold this year, but what ESG issues companies should get ahead of before shareholder proposals for 2024 emerge in the fall.

- Many investors publish proxy voting guidelines making it easier for companies to understand if they are at risk of not meeting expectations. Some proxy voting guidelines provide only a softly sketched outline of ESG topics, while many investors publish investment statements or stewardship principles which can bring these issues into better focus.

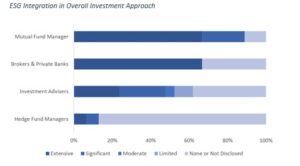

- Our proprietary analysis, based on 70 top investors in the healthcare space[3], provides a quantitative perspective on proxy voting and ESG. On one end of the spectrum, investors prioritize ESG at the core of their investment strategy, not just for ESG funds, but across all asset classes. Many investment advisors, mutual funds, private banks, wealth managers and even a limited number of hedge funds feature ESG prominently in their overarching investment strategy. In addition to employing ESG as a screening tool these investors integrate ESG factors into their standard risk, valuation and portfolio construction analyses for all products. Mutual fund managers are the most likely to include ESG in their overall investment strategy (89%), followed by brokers and private banks (67%) and investment advisors (62%). In terms of the extent to which asset managers embed ESG overall in investing, mutual funds look similar to brokers and private banks—two thirds of both groups leverage ESG extensively.

Investors on the other end of the spectrum may not factor ESG into their analysis at all or may consider a handful of ESG factors within their quantitative investment strategies. Hedge funds, small private companies and quantitative investors are the most likely to take a less stringent view on ESG.

By comparison, just over one in ten hedge funds embeds ESG in its overall investment strategy. By contrast, just under a quarter of investment advisors and fewer than one in ten hedge funds embed ESG extensively in their investing approach.

Investors who adopt ESG as a core component of their investment strategies increasingly leverage proprietary ESG data analytics platforms, software and scoring systems. Over three quarters of mutual funds in our study (78%) operate ESG analytics and scoring systems, generating proprietary ESG scores for companies. While less frequent outside mutual fund advisors, a third of investment advisors and nearly as many brokers and private banks (29%) leverage proprietary ESG analytics systems.

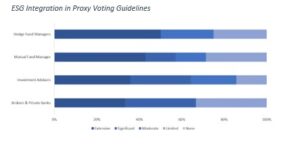

Investors with published proxy voting guidelines demonstrate a wide range of approaches to integrating ESG issues. Some companies integrate ESG extensively throughout their approach to proxy voting. These investors typically address ESG in the introduction to their voting guidelines and weave ESG topics, themes and requirements throughout. These investors take ESG into account when voting on traditional proxy proposals such as director nomination, and typically include a section in their proxy voting guidelines conveying their philosophy on voting environmental and social issues. These investors typically provide topic-specific guidance for voting on core issues including board diversity, climate risk and GHG emissions, but may include additional guidance on a broad array of issues from lobbying to animal rights. Investors with limited consideration of ESG may not use the words ESG at all in their proxy voting guidelines and may only provide guidance on one or two core issues such as board diversity or climate risk reporting. [5]

Today incorporation of ESG-related issues and topics in proxy voting has become the norm. All investors who publish proxy voting guidelines incorporate ESG into those guidelines. A large proportion of mutual fund managers, investment advisors and brokers and private banks feature ESG and ESG topics extensively in their proxy voting guidelines (43%, 36% and 33%, respectively). Though only 13 percent of hedge funds in our study publish proxy voting guidelines, half of those (2 funds) embed ESG issues extensively.

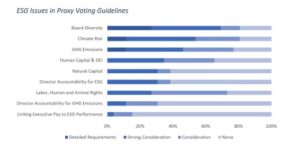

Many investors adopt a principles-based approach to voting ESG proxy issues. A small minority of investors provide detailed requirements, typically relating to board diversity and climate change. While fewer than a third of investors (27%) have strong voting considerations around labor, human and animal rights, nearly half (46%) consider these issues.

Health care companies face unique challenges when it comes to where to focus their ESG efforts. Investors who publish proxy voting guidelines are most likely to address board diversity and climate risk (both 81%), GHG emissions (77%) and human capital and DEI (65%). However, many healthcare companies, particularly biotech businesses, do not find GHG emissions to be a material issue for their firms. As a case in point, companies whose ESG frameworks are built solely around the Sustainability Accounting Standards Board (SASB) guidance will find themselves misaligned with the published proxy voting expectations of most investors, as SASB does not treat these issues as material for the healthcare industry.[6] Increasingly, companies must augment SASB guidance to satisfy investors.

A growing number of investors (38%) hold boards and executives responsible for ESG, with nearly a third (31%) holding directors responsible for their companies’ management of GHG emissions. A small but growing number of investors (15%) are calling for companies to link executive pay to ESG performance. These investors may vote against directors or compensation proposals for companies which fail to manage ESG and carbon emissions effectively.

Molly Podolefsky, Ph.D. (she/her/hers)

_________________________________________

[1] https://www.forbes.com/sites/chris-perry/2022/11/10/the-corporate-proxy-ballot-takes-center-stage-for-esg/?sh=5275f5f162e0

[2] https://www.wsj.com/articles/companies-brace-for-onslaught-of-new-activists-after-change-in-proxy-voting-rules-11668902603

[3] For a sample set of 52 public healthcare and biotech companies, sizes ranging from micro to large-cap, we identified the top 20 investors in each, defining the universe of 305 investors for our study, spanning hedge funds, investment advisors, mutual funds, sovereign wealth funds, wealth management companies and brokers. We then narrowed our focus by removing investors whose positions placed them in the top 20 holders for only one of the 52 companies, reducing our sample to 121 investors. From these, we randomly selected 70 investors, on which the findings in this article are based.

[4] For a sample set of 52 public healthcare and biotech companies, sizes ranging from micro to large-cap, we identified the top 20 investors in each, defining the universe of 305 investors for our study, spanning hedge funds, investment advisors, mutual funds, sovereign wealth funds, wealth management companies and brokers. We then narrowed our focus by removing investors whose positions placed them in the top 20 holders for only one of the 52 companies, reducing our sample to 121 investors. From these, we randomly selected 70 investors, on which the findings in this article are based.

[5] In addition to Extensive and Limited integration of ESG in proxy voting guidelines, companies may fall into either the Significant or Moderate categories. Significant: mentions ESG directly in the proxy voting guidelines, includes ESG in the introduction, may include a section on environmental and social issues, includes three or more sections with ESG issue-specific voting guidance, usually includes detailed requirements for several issues. Moderate: mentions ESG directly in the proxy voting guidelines, may include ESG in the introduction, may include a section on environmental and social issues, usually includes two or more sections with ESG issue-specific voting guidance, may lack detailed requirements.

[6] SASB’s Biotechnology and Pharmaceuticals Standard, published in 2018, does not include GHG emissions or climate risk as material issues for the industry. That standard can be downloaded on SASB’s website: https://www.sasb.org/standards/download/?lang=en-us.