The right board of directors can mean the difference between success and failure for a company. For biotech and pharma companies on the long and arduous road to commercialization, luck is a necessary, but not a sufficient, condition for success. While capital markets, the economy, the competitive landscape, and ultimately clinical trial results are outside a company’s direct control, it does control how it manages those risks—and the board’s role in risk management is paramount. Through strong corporate governance, the board positively impacts strategy, integrity, innovation, and quality, all of which are central to success.

With all of these responsibilities, why should boards pay attention to ESG? Some feel ESG is just another distraction keeping boards from focusing on real business needs, and if ESG is practiced just for its own sake—they are right. Meaningful ESG is grounded in materiality, aligned with business objectives, and primarily focused on identifying and managing the risks and opportunities facing a company. From this perspective ESG is not just compatible with, but essential to, the board’s role in managing a company.

Evidence suggests the majority of boards lack the awareness, understanding and experience to successfully manage ESG issues. A recent, large scale survey of corporate directors found that roughly half did not feel their boards had a strong understanding of the ESG issues impacting their companies. Only 38% of surveyed directors believed ESG issues could financially impact a company’s performance, and less than half saw a link between ESG issues and the company’s strategy.[1] Underlying the issue, a study by NYU Stern Center for Sustainable Business found few board members have skills and expertise related to material ESG issues facing companies. The study found workplace diversity to be the most common area of director expertise related to ESG, yet only 5% of directors had experience with this topic.[2] This deficit in ESG capability is alarming given directors have a fiduciary responsibility to make informed decisions, many involving ESG issues, to represent shareholder interests and safeguard the company’s long-term success.

Global ESG reporting frameworks, rating and ranking agencies, investors and customers increasingly expect to see boards not just aware of, but directly involved in the management of, ESG issues. Leading ESG framework Global Reporting Initiative (GRI) requires companies to disclose “measures taken to advance the collective knowledge, skills, and experience” of their board on ESG.[3] State Street Global Advisors CEO Yie-Hsin Hung reaffirmed her company’s expectations around director oversight of ESG in her 2023 letter to board members, stating the company “has consistently viewed [ESG] issues through a lens of long-term value creation” and believes these risks and opportunities are “important for portfolio companies to manage and boards to oversee.”[4]

Adding more directors with ESG credentials to boards will improve the dynamic over time, but this is a long-term solution to a more immediate problem. In the near-term, companies should work to improve boards’ understanding of ESG, its intersection with traditional enterprise risk management, and ways to use it effectively to create value. As they consider such issues as clinical trial diversity, product accessibility, research ethics and supply chain traceability, boards should understand which issues are material, what best practice looks like, what information is beneficial for a company to disclose and through what channels.

The single most useful step biotech and pharma companies can take to mitigate this problem is to invest in educating their boards on ESG. Companies can generate goodwill with investors by demonstrating a commitment to improve sustainable governance through ESG education and capacity building within the board. Companies undertaking ESG board education also improve lagging ESG stakeholder governance scores and ESG ratings by disclosing these initiatives on their websites and in annual reports and SEC filings.

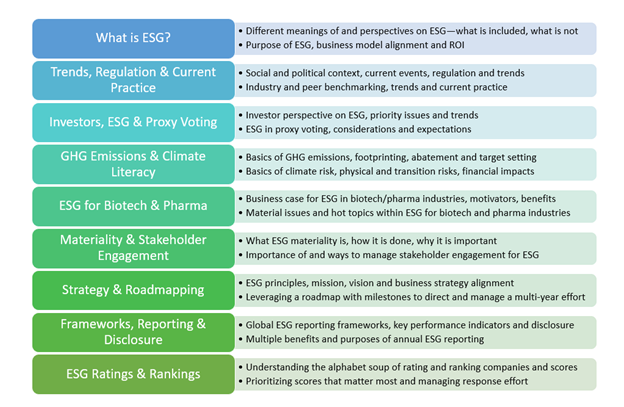

What does board ESG education entail? While there are many different approaches, best-in-class ESG board education initiatives leverage outside ESG vendors to prepare and deliver ESG education sessions to the board. The training can be either a single multi-hour event or structured as a series of shorter, bite-sized sessions over several months. Education sessions should be tailored to the company based on its material issues and business type to maximize value and return on investment and should cover some version of the topics in Figure 1. to ensure a holistic understanding of ESG by the board:

The benefits companies realize through ESG board education are significant. Board members benefit from being able to ask questions and learn about this complex topic in a safe space, upgrading their skills and gaining confidence in responding to ESG questions that may arise interacting with investors and other stakeholders. The company benefits by ensuring the board is well-versed in the issues, capable of making informed decisions, and prepared to play a more significant role in ESG governance.

Fall is the right time for biotech and pharma companies to plan their investments for the coming year. 2024 will be an important year for ESG, as many large-cap companies and an increasing number of SMID-cap firms take on ESG in a meaningful way, and as the SEC prepares to publish its final guidance on mandatory climate and emissions reporting for publicly traded companies.[5] Optimistic observers remain hopeful that capital markets will improve for biotech and pharma companies in the coming year as well, highlighting the importance of ESG for firms preparing for life as public companies.[6] Finally, proxy season this year saw many institutional investors ratchet up pressure on their portfolio companies to improve ESG governance, and that pressure will only increase in 2024. Whether as part of an integrated ESG program launch or a stand-alone initiative, Stern IR encourages biotech and pharma companies to undertake ESG education this Fall to ensure their boards have the education and training needed to help companies create lasting value.

[1] https://cooleypubco.com/2021/01/21/boards-enough-esg-expertise/; https://www.pwc.com/us/en/services/governance-insights-center/assets/pwc-2020-annual-corporate-directors-survey.pdf.

[2] https://cooleypubco.com/2021/01/21/boards-enough-esg-expertise/; https://www.stern.nyu.edu/sites/default/files/assets/documents/U.S.%20Corporate%20Boards%20Suffer%20From%20Inadequate%20%20Expertise%20in%20Financially%20Material%20ESG%20Matters.docx%20%282.13.21%29.pdf

[3] GRI Standards GRI 2: General Disclosures 2021, Disclosure 2-17 Collective Knowledge of the Highest Governance Body; https://www.globalreporting.org/standards/download-the-standards/

[4] https://www.ssga.com/us/en/institutional/etfs/insights/2023-proxy-focus

[5] https://www.wsj.com/articles/secs-climate-disclosure-rule-isnt-here-but-it-may-as-well-be-many-businesses-say-854789bd

[6] https://www.sustainalytics.com/esg-research/resource/corporate-esg-blog/how-an-esg-assessment-can-make-a-difference-to-your-ipo

______________

Molly Podolefsky, Ph.D. (she/her)|Managing Director, ESG